Home equity line of credit ltv calculator

Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home. As a result they have a wealth of experience in the area which really shows when you discuss your home equity line of credit or HELOC with a Chase Bank loan officer.

Home Equity Line Of Credit Qualification Calculator

Start with our refinance calculator to estimate your rate and payments.

. Choosing a home equity loan vs. Using the equity youve built in your home we can provide you with a revolving line of credit to help you finance important purchases or consolidate high-interest debt. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

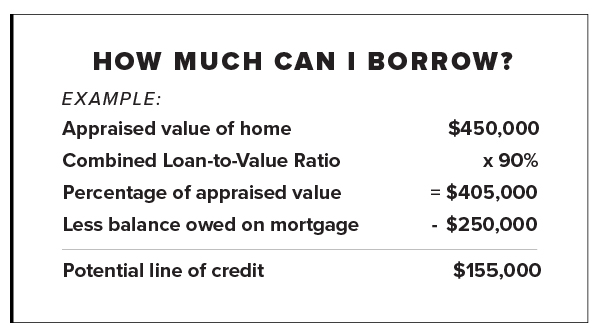

The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. 15000 to 750000 up to 1 million for properties in California. If you own at least 20 of your home an LTV of 80 or.

This election of Interest-Only or Principal and Interest payments may be changed every 12 months. A home equity line of credit HELOC is a revolving source of funds much like a credit card that you can access as you choose. So your combined loan-to-value equation would look like this.

Obtaining the best rate requires the following criteria to be met. If used correctly however it can decrease your total credit utilization rate and act as a positive indicator of good borrowing behaviour. Where home price trends are strong and the borrower has an excellent credit rating some lenders may allow borrowers to access up to 90 of a home.

Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. 1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account or in the states listed below any checking account set up with automatic monthly payment deduction at. Home Equity Line of Credit HELOC Print Home equity lines of credit are currently unavailable.

Youre consolidating or paying off high-interest long-term debt. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. A home equity line of credit HELOC unlocks the value of your home by allowing you to borrow against the equity through a revolving line of credit.

As of 08312022 this variable HELOC APR would have been 549 APR for 80 LTV. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. For a limited time you can get a 099 introductory annual percentage rate APR for six months.

APR Annual Percentage Rate. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. Heres how youd calculate the maximum home equity loan on a 350000 home with a.

Input the repayment period of your line of credit. It can also display one additional line. 3 Your homes equity which is calculated by subtracting any mortgages or liens from the market value of your home is an asset you can tap into for financing whats important to you.

Because the loan is secured by your home the interest rate may be lower than other unsecured types of credit making it an ideal solution to finance home improvements or other major expenses. With a Home Equity Line of Credit you will choose if you want to make Interest-Only or Principal and Interest payments during the 10-year Draw Period when you have access to your line of credit up to your available credit limit. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

No closing costs with a new home equity loan or line of credit under 500000. Introductory rate for the line of credit as low as 399 for the first year then the APR will vary for the remaining life of the loan. It acts as a revolving line of credit similar to a credit card and a high utilization rate can negatively impact your credit score.

Home Equity Loans. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Current rates range from 575 to 12625 APR 1.

Use this home equity loan calculator to see if a lender might give you a home equity loan and how much money you might be able to borrow. 12 Enjoy an intro rate on a HELOC as low as 199 APR for six months and 550 to 1800 APR after that. Learn more on how home equity line of credit and home equity loans work and compare plus calculate your estimated HELOC.

Applying for a HELOC could potentially affect your credit score. Youre making a major renovation to improve your homes value such as. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

Whether youre funding home renovations sending a child to college or helping pay for a wedding well work alongside you to find a lending option that works best. 1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan and. Learn more about cash-out refinancing.

Ie the period during which you will make both interest and principal payments Provide the date at which your loan commenced month and year Hit the Calculate button to obtain the HELOC calculation. Although most home equity lenders let you tap up to 80 of your homes value some lenders may offer high-LTV home equity loans that allow you to borrow more. You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or online account and you want to take out a 25000 home equity line of credit.

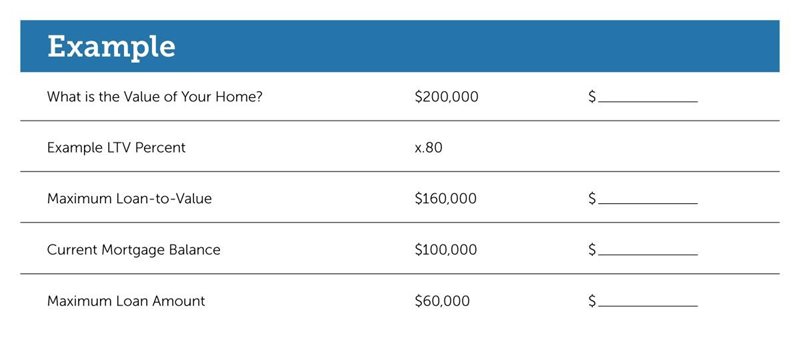

Loan-to-value ratio LTV The amount you owe on your loan divided by your homes original value which is either the price you paid. Their LTV calculator was incredibly easy to use and they have a large number of physical branches that you can walk into in order to get help with your. Your home currently appraises for 200000.

Generally you can expect to need a minimum 620 credit score a DTI less than 50 and a max LTV. Obtaining the best rate also requires the following criteria to be met. It allows home owners to borrow against.

Rates Requirements Calculator. This would mean that if a lender has a max LTV of 80 a borrower could borrow up to an additional 25 of the value of the home 50000 via either a home equity loan or a home equity line of credit. Like second mortgages and HELOCs cash-out refinances have their own credit LTV and DTI requirements.

A home equity line of credit A home equity loan makes sense if. Home Equity Line of Credit We make it easy to apply for a Home Equity Line of Credit so you can focus on the important things in life. After that a variable rate applies.

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator House Line Of Credit Calculator Tbcu

Home Equity Line Of Credit Heloc Macu

How To Calculate Your Home Equity Finder Com

Calculate Home Equity Line Of Credit Heloc Mortgage Rate Pfcu

Home Equity Line Of Credit Heloc Uccu

How To Calculate Your Loan To Value Ratio Finder Com

Heloc Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Calculator Union Bank Of Mena

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Calculator Heloc Loan Rates Crcu

Home Equity Line Of Credit Calculator Exchange Bank

Heloc Calculator To Calculate Maximum Home Equity Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

How Much Equity Do You Have In Your Home